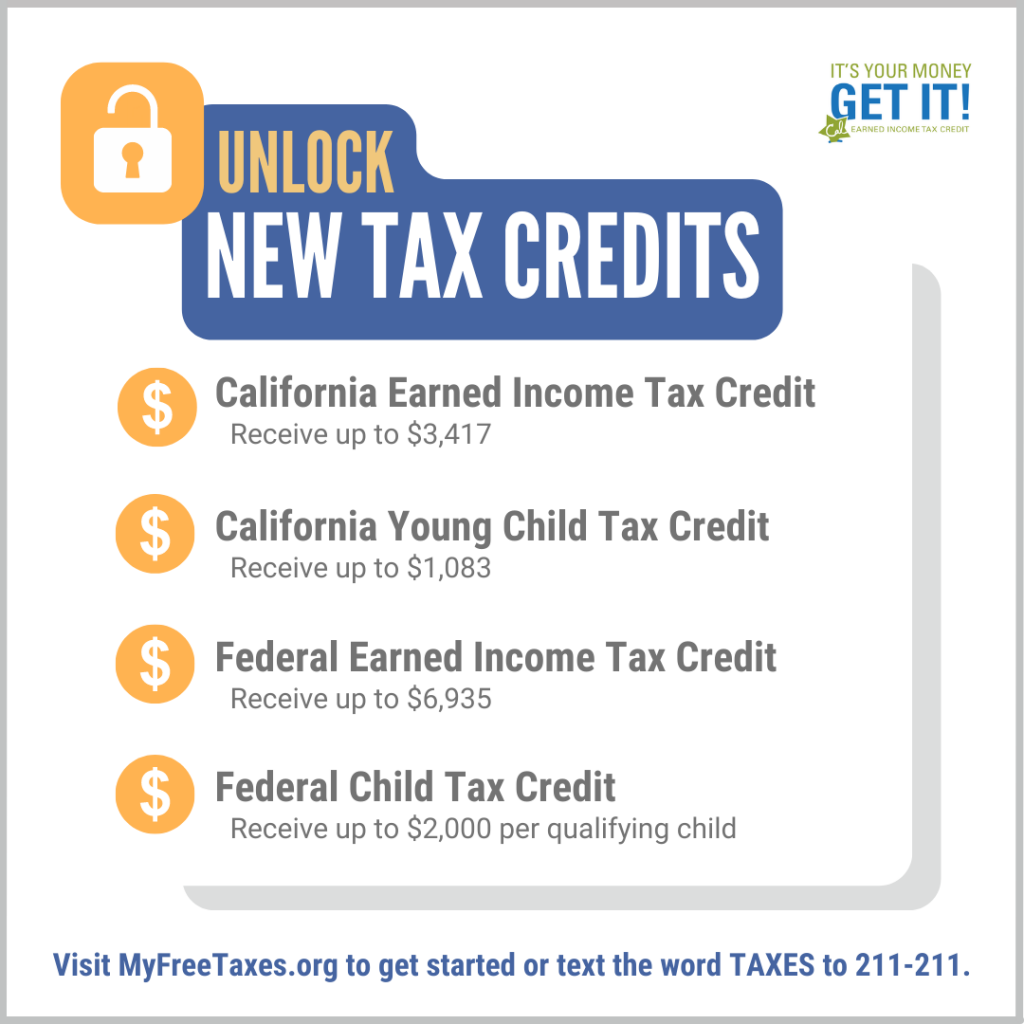

The California Earned Income Tax Credit (CalEITC) and the Young Child Tax Credit (YCTC) are state tax credits for working Californians and you may be eligible to receive a cash refund or reduce the amount of tax you owe.

These tax credits, along with the state Foster Youth Tax Credit (FYTC) and the federal EITC, can combine to put hundreds or even thousands of extra dollars in your pocket. That’s money you can use for rent, school tuition, utilities, groceries and other important expenses.

What is the CalEITC?

The California Earned Income Tax Credit (CalEITC) is a cash-back refund and California’s supplemental boost to the federal Earned Income Tax Credit. Research suggests the credit leads to long-term positive outcomes in health, financial stability, and education for working Californians.

Click here to learn more about CalEITC.

File your taxes for free!

United Way Bay Area is providing free, secure, high-quality tax help for low- and middle-income residents across the Bay Area.

- In-person tax preparation and drop off may be available in your area—please be sure to contact sites directly to verify days and hours of operation as they may change without notice.

- Online tax preparation is also available through a partnership with Code for America.

Click here for free tax help in the Contra Costa (and the Bay Area).